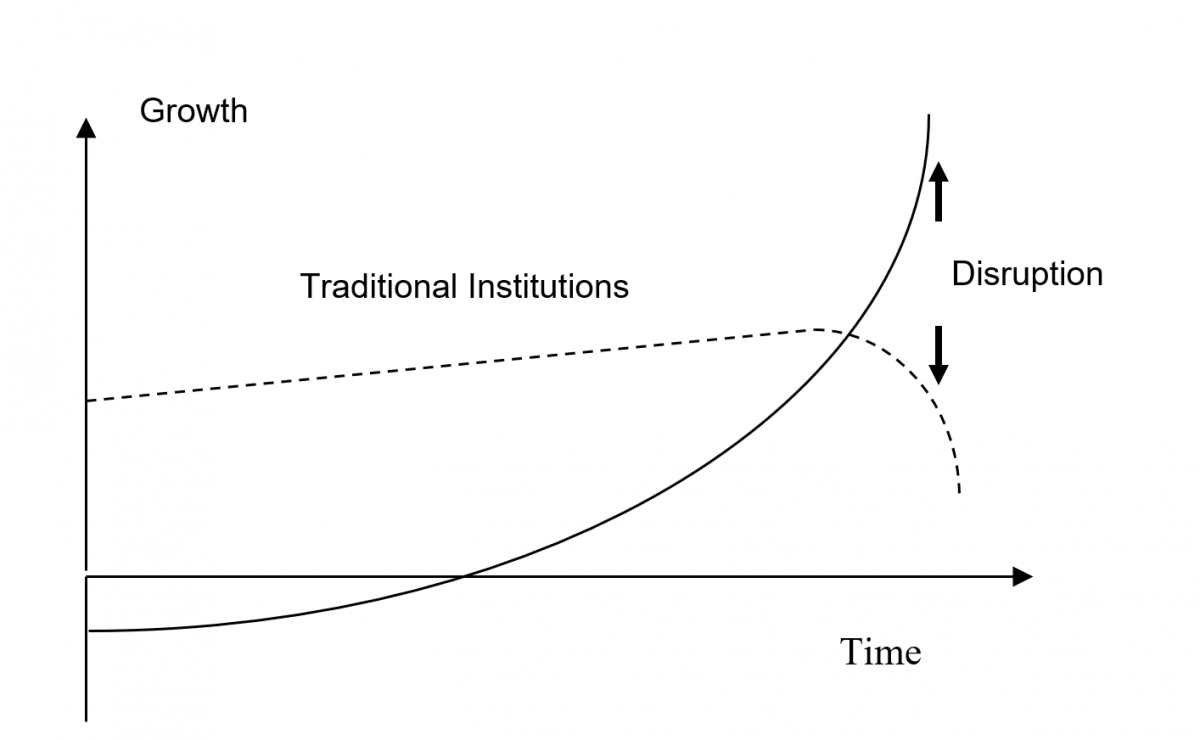

From incremental improvement to disruptive innovation

The underlying concept of strategy development is based on linking technological progress with the possibility of futures fundamentally different from the past. Unlike normal or incremental innovation strategies aiming at improving

- existing products and services,

- organizational structures and processes

- or expanding markets and customer bases

- or sources of supply gradually

And as a fifth exceptional mode of innovation

(5) strategies based on breakthrough technologies like electric power in the late 19th century or digital transformation and platform strategies of the 21st century aiming at fundamental or radical changes of industries on a global scale or the establishment of new industries

These five types type of innovation already had been distinguished and exemplified by Joseph A. Schumpeter (1911; 1948). Schumpeter considered type 5 of innovations as unique and typical for the ‘gilded age’ because the application of a large number of novel technologies in transport, energy, physics and chemistry, led to the formation of new monopoles and the destruction of traditional structures.

Nowadays we are not talking about a fifth, fundamental type of innovation like Schumpeter, but about radical or disruptive innovation vs. incremental innovation or like Peter Thiel, the eccentric libertarian PayPal founder and Silicon Valley Venture Capitalist, expressed it at in his lecture series on start-ups at Stanford University: The vision or idea to do new things differently vs. scaling up and improving things that already works are the fundamental difference between promising start up and longtime established ventures in various industries. (Thiel, P., Masters B., 2015).

Schumpeter argued that the dynamics of the early days of large corporations the late 19th and early 20th century won’t occur again because the created large bureaucratic structures are interested in gradual improvement only. He didn’t believe that new revolutionary scientific discoveries would come up; corporations would compete on efficiency improvements only based on the existing set of basic technologies and their improvement. In his landmark volume on Capitalism, Socialism and Democracy (1942) he also foresaw the differences between capitalism and socialism dwindling as the innovation dynamics of capitalist market economies inevitably would slow down by time: A creative destruction of existing economic structures and ways of social life was no longer to be expected. Nowadays we know that Schumpeter had good arguments but he was wrong! The current generations of humans are experiencing life changing radical, disruptive innovation on a global scale not only in the economy but also in other institutional context of the society and in their daily lives.

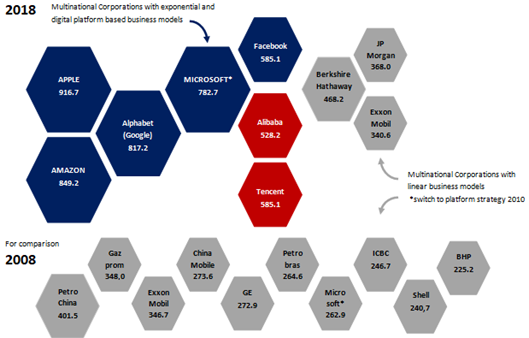

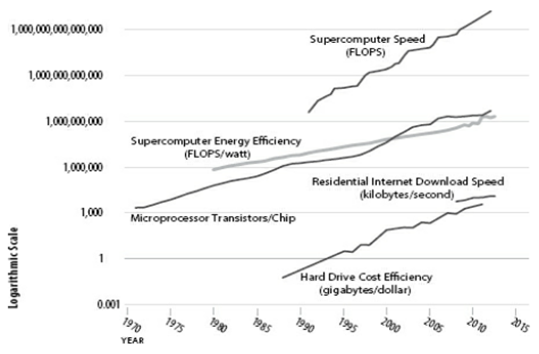

Defining digital transformation and linking it precisely to the historical development in digital computation and communication is nearly impossible. Terms like the ‘fourth industrial revolution’ (coined by Klaus Schwab and the World Economic Forum, WEF) are as complex as the ‘second machine age’ announced by the MIT Economists Brynjolfson and MacAfee. However, the idea that ‘Artificial Intelligence’ or ‘Machine Learning’ is at the core of the current technology driven innovation strategies of extraordinary successful transnational or multinational corporations has arrived in the mainstream. The consultancy giant McKinsey and its MGI Global institute are dishing out guides to AI applications on regularly base (McKinsey, 2019) Business Faculties and Business Schools across the globe launching programs to cope with the current innovation dynamics in fields like digital leadership, strategy, organization, marketing, finance etc..

When it comes to a comprehensive account of the science behind the technological development the reader is referred to the seminal book of Terry Sejnowski (2018) ‘The Deep Learning Revolution’ or the compilation of interviews with leading scientists in the field by Martin Ford (2018), ‘Architects of Intelligence’. But for now, it is enough to point out that all of the 7 MNC’s with the highest market evaluation are organized around the idea of digital transformation as explained above.